Blog Questions about beds and mattresses answered. And some stories told.

Health insurance coverage can vary widely depending on the insurance provider, the specific policy you have, and the region you reside in. Some health insurance plans may cover the cost of a home hospital bed, while others may not. It typically depends on whether the bed is considered medically necessary and if it meets specific criteria set by the insurance company.

To determine if your health insurance will cover the cost of a home hospital bed, you should contact your insurance provider directly. They can provide you with the most accurate and up-to-date information regarding your specific policy. You can usually find their contact information on your insurance card or policy documents.

When speaking with your insurance provider, it's helpful to have the following information ready:

- The reason why a home hospital bed is necessary (such as a medical condition or recovery from a surgery).

- Any supporting documentation from your healthcare provider, such as a prescription or recommendation for a home hospital bed.

- The specific model and cost of the bed you are considering.

By discussing your situation and providing the necessary information, your insurance provider can inform you about the coverage options available to you. They can also explain any requirements, such as prior authorization or specific suppliers you should work with.

Remember that it's essential to consult your insurance provider directly, as they are the ones who can provide the most accurate and personalized information regarding your coverage.

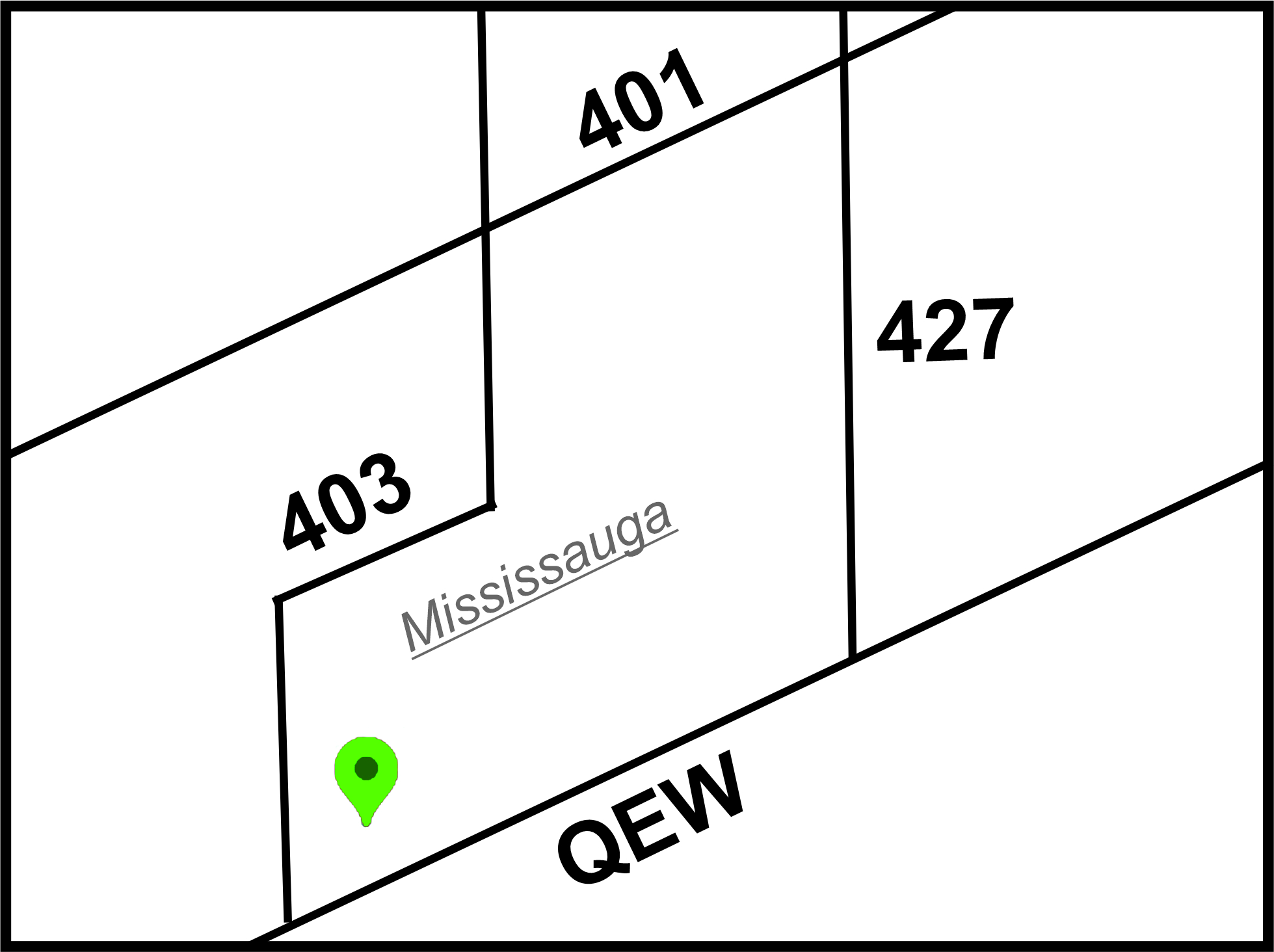

Nine Clouds Beds can provide written quotations for you to take to your insurers.

Copyright © 2026 |

Copyright © 2026 |