Blog Questions about beds and mattresses answered. And some stories told.

Global electronics manufacturing never fully recovered its pre-2020 rhythm, and adjustable-bed remotes sit at the far end of that kinked supply hose. Handsets use tiny batches of niche micro-controllers, RF transceivers, and discrete power-management parts. During the worst of the component crunch, foundries and packaging houses shifted scarce wafer starts toward high-volume phone and laptop chips, pushing low-volume orders onto endless back-order lists. Makers of adjustable bases—who might need only a few truckloads of chips each year—were forced onto the spot market, where brokers charged multiples of the contract rate. Many brands tried quick redesigns to swap in whatever silicon was actually shipping, but that meant fresh tooling, firmware rewrites, and compliance testing. Each workaround raised the bill of materials, and those step-ups never flowed back down once normal deliveries resumed. Even today, remotes still depend on allocation-only parts, so factories build shorter runs, and every per-unit cost gets padded to offset the uncertainty.

Freight costs then piled on. The sudden mismatch between container supply and demand sent base ocean rates soaring more than four-fold, while surcharges for premium loading windows, chassis rentals, and port storage turned what had been background noise into a headline expense. A remote control is small, but it seldom fills a pallet; it usually rides in less-than-container consignments that pay the highest per-cubic-foot fees. Some distributors tried air freight to keep shelves stocked, only to find that pandemic-era capacity shortages drove airborne tariffs even higher. Even now, with mainlane rates moderated, charges for LCL handling, inland drayage, and mandatory security screenings remain well above 2019 norms. Because a handset’s factory cost is modest, any extra twenty or thirty dollars of shipping translates almost one-for-one into the sticker price visible on parts sites and retail marketplaces.

Layered onto chips and freight are trade barriers that were erected in the late 2010s and broadened several times since. Remote controls fall under a customs code for wireless apparatus, a line item that acquired double-digit import duties meant to encourage onshore sourcing of semiconductor-based goods. Brands that already owned tooling abroad simply paid the levy, marked it up, and passed it along. The surcharge cascades: customs duty becomes part of landed cost, which becomes the basis for distributor margins, which becomes the starting point for retailer mark-ups. Additionally, the political risk of future tariff hikes is now priced in by freight forwarders, insurers, and currency-hedging desks, all of whom collect small premiums that ultimately accumulate in the consumer’s invoice.

Scarcity in the aftermarket magnifies those structural costs. Each adjustable base generation uses a proprietary radio code set and distinct button layout; once a frame is discontinued, its matched handset drops out of the factory order book. The leftover service stock—often only a few hundred units—vanishes quickly, snapped up by mattress stores and parts aggregators. After that, the only sources are salvage operations and casual resellers who dismantle broken beds. With no cross-brand “universal” option, owners of a dead remote are bidding against one another for a dwindling pool. Online auctions routinely escalate past two hundred dollars, not because the plastic shell is valuable, but because the embedded microcontroller contains the only code that will wake their lift motors.

Meanwhile, what designers put into a modern handset keeps getting richer. Early models merely raised the head and foot; current ones add under-bed lighting, two-zone massage, programmable presets, zero-gravity macros, USB charging triggers, and sometimes Bluetooth or Wi-Fi bridging. Every extra feature needs more buttons, brighter back-lighting, bigger batteries, additional regulatory checks, and firmware with over-the-air update hooks. Engineering hours, certification lab time, and mold revisions are fixed costs spread across very small production runs—often only tens of thousands of units over a multiyear life cycle—so the per-unit recovery charge is high. The result is a product that looks simple but is priced like a short-run medical device rather than a mass-market television clicker.

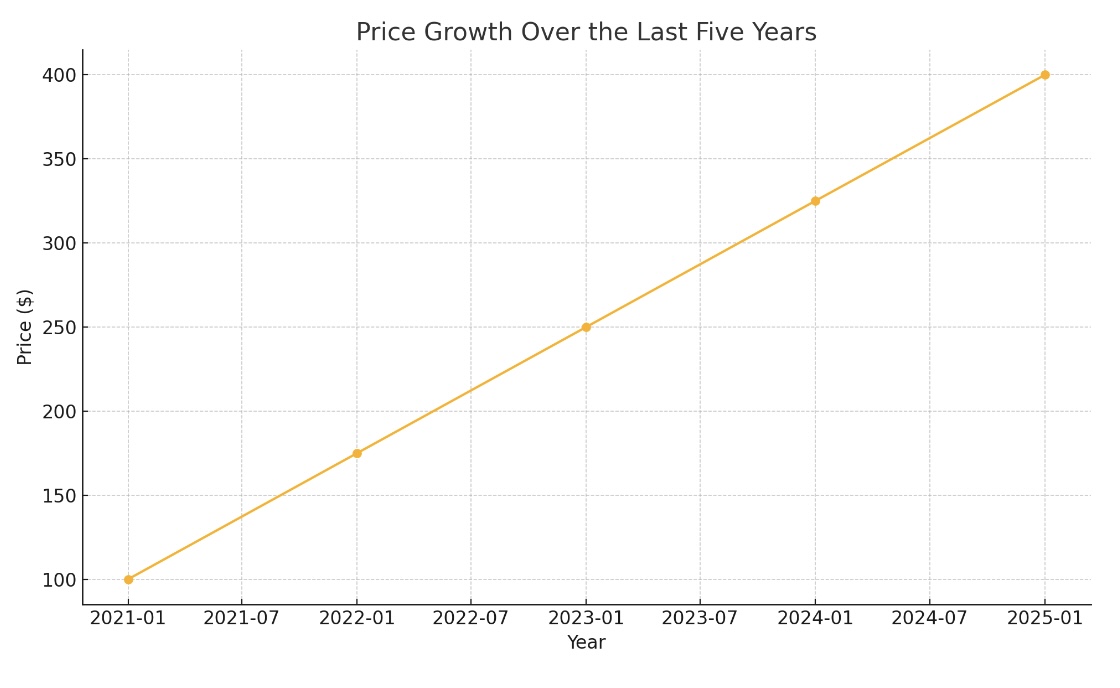

Finally, ordinary cost creep seals the increase. Prices for molded resins, copper traces, silicone keypads, recyclable packaging, and factory labor have all risen in the mid-teens percentage range since the last decade. Energy surcharges now apply to plastics and circuit-board curing ovens; wage floors in primary assembly zones are up sharply; and domestic fulfillment centers pay more for both labor and rent than they did five years ago. Stack these incremental hikes on top of the giant leaps in chips, freight, tariffs, scarcity, and feature creep, and a replacement remote that once sold for under one hundred dollars now routinely commands between one-fifty and two-fifty. Unless adjustable bases abandon dedicated handsets entirely and rely on phone apps, those elevated prices are likely to linger rather than retreat.

Our recommendation is to buy at least one extra remote when you purchase your adjustable bed and leave it in a night table drawer for that rainy day when you'll need it.

|

|

|

Copyright © 2026 |

Copyright © 2026 |